Introduction

Mergers and acquisitions (M&A) are pivotal strategies for business growth, restructuring, and diversification. Whether you’re a business owner considering a merger, a potential buyer, or simply curious about the M&A process, understanding the fundamentals of these transactions is crucial. In this blog post, we’ll dive into the essentials of mergers and acquisitions, including their benefits, challenges, and key steps involved. We’ll also address some frequently asked questions to provide clarity on this complex topic.

What are Mergers and Acquisitions?

- Mergers occur when two companies combine to form a new entity. This often involves a mutual decision to join forces for strategic reasons, such as expanding market reach or enhancing operational efficiencies.

- Acquisitions involve one company purchasing another. This can be either a full acquisition, where the buyer takes over the entire target company, or a partial acquisition, where only a portion of the target’s assets or shares are purchased.

Benefits of Mergers and Acquisitions

- Growth and Expansion M&As can significantly accelerate a company’s growth by expanding its market presence, acquiring new technologies, or entering new geographic regions. For example, a company might acquire a competitor to increase its market share or merge with a company in a different industry to diversify its offerings. Explore how M&As drive growth and expansion.

- Synergies and Efficiency Combining resources and operations can lead to synergies that enhance efficiency and reduce costs. Synergies might include shared technology, streamlined operations, or consolidated administrative functions. These efficiencies can improve profitability and operational performance. Learn about the types of synergies that result from M&As.

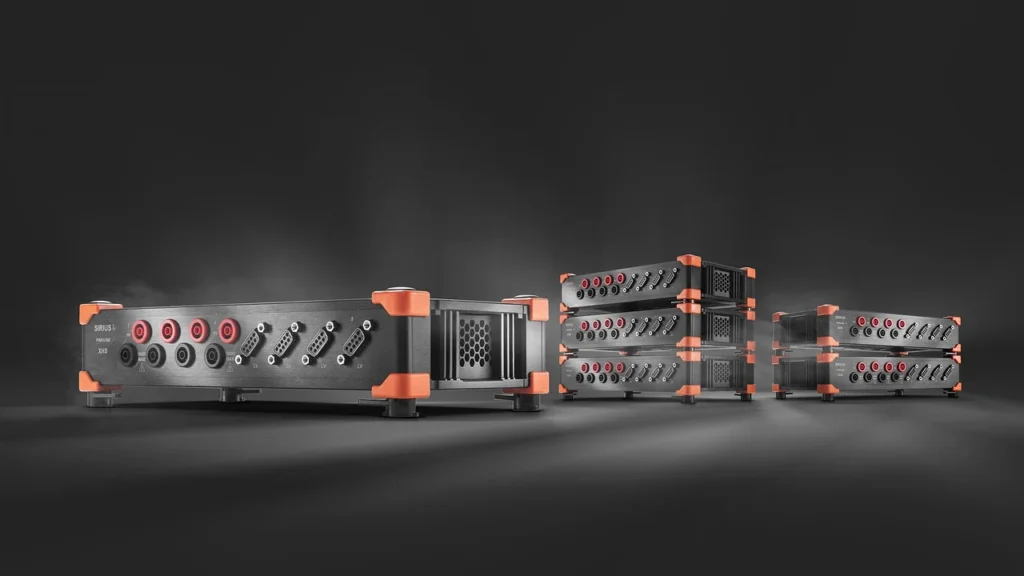

- Access to New Markets and Technologies M&As can provide access to new markets and cutting-edge technologies that would be difficult or time-consuming to develop independently. For example, acquiring a company with advanced technology can give the acquiring company a competitive edge in innovation. Find out how M&As open doors to new markets and technologies.

- Enhanced Competitive Position M&As can strengthen a company’s competitive position by eliminating competitors, increasing market share, or enhancing bargaining power with suppliers and customers. This can lead to a stronger market presence and better financial performance. Discover how M&As enhance competitive positioning.

Challenges of Mergers and Acquisitions

- Cultural Integration One of the most significant challenges in M&As is integrating the cultures of the merging or acquiring companies. Differences in corporate culture, management styles, and operational practices can lead to conflicts and affect employee morale. Learn about managing cultural integration in M&As.

- Regulatory and Legal Issues M&As often face regulatory scrutiny and legal challenges. Antitrust laws, industry regulations, and compliance requirements can impact the transaction process. Ensuring that all legal and regulatory obligations are met is crucial for a successful M&A. Explore common regulatory and legal issues in M&As.

- Financial and Valuation Risks Accurately valuing the target company and assessing its financial health is essential for a successful acquisition. Misjudging the value or financial condition of the target can lead to financial losses and negative impacts on the acquiring company. Read about financial and valuation risks in M&As.

- Operational Disruptions The integration process can cause operational disruptions, including changes in management, restructuring, and shifts in business processes. Managing these disruptions effectively is crucial to maintaining business continuity and minimizing adverse effects. Discover strategies for managing operational disruptions during M&As.

Key Steps in the M&A Process

- Strategic Planning Before initiating an M&A, it’s essential to define the strategic goals and objectives. This includes identifying the target company or potential buyers, assessing how the M&A aligns with business objectives, and developing a plan for the transaction. Learn about the importance of strategic planning in M&As.

- Due Diligence Due diligence involves thoroughly investigating the target company’s financials, operations, legal status, and market position. This process helps identify potential risks, liabilities, and opportunities, providing a clearer picture of the target company. Find out what to look for during the due diligence process.

- Negotiation and Valuation Negotiating the terms of the M&A agreement and determining the valuation of the target company are critical steps. This involves discussions on purchase price, payment structure, and other terms of the deal. Valuation methods may include financial analysis, market comparisons, and projections. Explore negotiation strategies and valuation methods in M&As.

- Integration Planning Successful integration is key to realizing the benefits of an M&A. This involves planning and executing the integration of systems, processes, and personnel. Effective integration can maximize synergies and ensure a smooth transition. Learn about best practices for integration planning.

- Closing the Deal The final step is to execute the legal agreements and complete the transaction. This includes finalizing contracts, obtaining necessary approvals, and addressing any remaining issues. Once the deal is closed, the focus shifts to implementing the integration plan. Read about the closing process in M&As.

Frequently Asked Questions

- What are the main reasons companies pursue mergers and acquisitions? Companies pursue M&As for various reasons, including growth, diversification, acquiring new technologies, gaining competitive advantages, and achieving operational efficiencies. Find out more about why companies pursue M&As.

- How long does the M&A process typically take? The M&A process can vary in duration depending on the complexity of the transaction, the size of the companies involved, and the regulatory requirements. On average, the process can take several months to over a year. Learn about the typical timeline for M&As.

- What role do legal and financial advisors play in M&As? Legal and financial advisors provide essential support throughout the M&A process. Legal advisors handle regulatory compliance, contract negotiations, and legal due diligence, while financial advisors assist with valuation, financial analysis, and structuring the deal. Discover the roles of legal and financial advisors in M&As.

- Can M&As be reversed or undone?